By Bob Allen

A Baptist preacher taken in by the largest tax scam in IRS history shared his story at a U.S. Senate hearing April 15 in Washington.

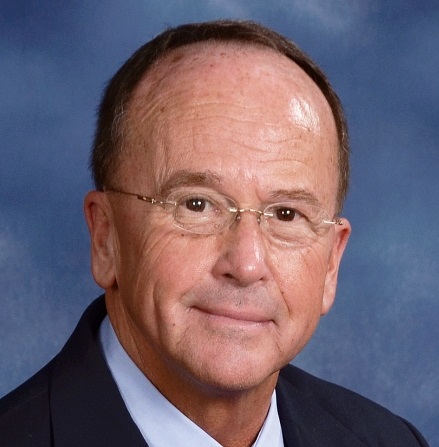

“I am sharing my experience for one reason only,” Al Cadenhead, senior pastor of Providence Baptist Church in Charlotte, N.C., said at a Senate Special Committee on Aging hearing about criminals posing as IRS agents calling Americans all across the country. “It is with hopes that my involvement might assist in stopping this scam and prosecuting these criminals.”

“I am sharing my experience for one reason only,” Al Cadenhead, senior pastor of Providence Baptist Church in Charlotte, N.C., said at a Senate Special Committee on Aging hearing about criminals posing as IRS agents calling Americans all across the country. “It is with hopes that my involvement might assist in stopping this scam and prosecuting these criminals.”

Victims are told they owe back taxes they must pay immediately or face arrest. Millions of Americans have received the calls, and thousands have been defrauded.

The Federal Trade Commission received nearly 55,000 complaints about IRS imposter scams last year, the single largest type of complaint it received, and the number is growing rapidly. Government officials estimate that 10,000 IRS impersonation scam calls are placed every week.

It happened to Cadenhead, 67, who retires in two weeks after 46 years in the ministry, with a voice mail left on his cell phone last October. A woman identifying herself as an IRS agent said he was being charged with tax fraud for serious miscalculations on past tax returns, and he or his attorney should return the call immediately.

The woman claimed the IRS had made numerous attempts to reach him, and he was in serious trouble. They were issuing a warrant for his arrest, he was told, and that they were placing a lien on his house and freezing his accounts because he had failed to cooperate. She also said they would be notifying the local media about the arrest.

She transferred Cadenhead to a “supervisor,” who identified himself as Steve Evans and gave a badge number. The man instructed Cadenhead to pay $4,900 by purchasing pre-paid debit cards at local retail outlets, loading them with cash and reading the pin numbers on the back of the cards over the phone. Throughout the day the scammers kept upping the amount, and by the time Cadenhead realized he was being duped he was out $16,500.

Cadenhead told the Senate panel it’s fair to ask how he could have been so gullible. “The short answer is that I was the perfect victim,” he testified. “I have never had any issues with the IRS and had no idea as to how they operate.”

Cadenhead said he remembered many years ago his father having a difficult experience with the IRS, and the agency never responded when they found out his calculations were correct. Never having paid so much as a traffic fine, it also didn’t seem unreasonable to him that the government would dictate the method of payment.

“The scammers also talked a lot about notifying the media, and in my profession that could be a nightmare,” he said. “So, I was the perfect victim.”

Committee chair Sen. Susan Collins (R-Maine) said the scheme is particularly effective because the calls, probably originating in India, use Voice over Internet Protocol to spoof phone numbers beginning with “202,” the area code for Washington, D.C.

“Pastor, I want to tell you how much I appreciate your willingness to come forward and tell your story publicly,” Collins said. “You’re going to save a lot of people from going through what you did.”

Sen. Claire McCaskill (D-Mo.), the ranking member on the committee, said it’s easy to fall for the scam, because “all of us have a natural fear of the IRS.”

“I appreciate the bravery of someone like our witness Dr. Cadenhead, who is stepping forward in hopes that others can learn from his painful experience,” McCaskill said.

“It’s easy to see why he and thousands of others have fallen for this,” McCaskill said. “The IRS is an agency that does strike fear in Americans’ hearts, and many are scared of both the tax code and its complexity and the agency itself. So when they receive a threatening call from what appears to be a 202 area code, it’s no wonder that many people believe what they are hearing.”

“I’m going to say something to the American people that should warm their hearts,” McCaskill said. “If you get a call out of the blue from the IRS, don’t answer it. Let it go to voice mail. Pick up the phone and hang it up.”

McCaskill said the IRS uses the telephone only as a last resort after multiple notices in the mail and does not dictate the method for taxpayers to pay what they owe.

“So if you for some reason find yourself in a phone call with someone purporting to be an IRS agent, demanding that you send money through a debit card or a credit card, without giving you an option on how you want to pay, that should be another red flag,” she said.

“Frankly, you shouldn’t even engage these people,” McCaskill added. “If you are concerned your call could be legitimate, call our committee’s fraud hotline to check it out, call your member of Congress, call the FTC, call the Inspector General of the Treasury Department, or call the IRS and talk to the IRS about the call you have received.”

Cadenhead said he takes no pleasure in sharing what he views as an embarrassing experience.

“My only reward for being public with my shame is to communicate to as many people as possible that the IRS does not do business over the phone — and that when calls are received, hang up,” he said. “That is my reason for being present with this body today.”