A federal appeals court on Friday gave its blessing to tax-free housing allowances for ministers of the gospel, overturning a lower court decision that found the 60-year-old benefit unconstitutional.

A three-judge panel of the 7th U.S. Circuit Court of Appeals in Chicago said the so-called “parsonage allowance” in the tax code “falls into the play between the joints of the Free Exercise Clause and the Establishment Clause: neither commanded by the former, nor proscribed by the latter.”

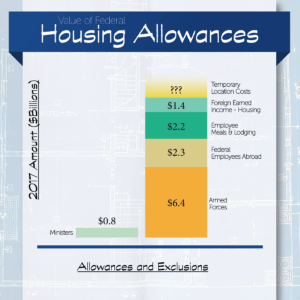

Housing allowance graph from Becket

Section 107(2) extends the “convenience-of the-employer” doctrine – that housing provided to employees for the convenience of their employer is exempt from taxable income – to the rental value of a church-owned parsonage or the amount of salary paid to a minister to rent or own a home.

The Wisconsin-based Freedom From Religion Foundation filed a lawsuit in 2016 claiming the rule “renders unto God that which is Caesar’s,” according to Friday’s opinion written by Circuit Judge Brennan. U.S. District Judge Barbara Crabb agreed, ruling in October 2017 that providing a tax benefit to clergy not available to others violates the separation of church and state.

Reversing that decision, Brennan, a Donald Trump appointee confirmed by the Senate last May, opined that the parsonage allowance “has a secular legislative purpose, its principal effect is neither to endorse nor to inhibit religion, and it does not cause excessive government entanglement,” a three-prong test established by the Supreme Court in 1971.

The court also applied a more recent test used in 2014 decision finding the Establishment Clause must be interpreted “by reference to historical practices and understandings,” noting that Congress has enacted federal tax exemptions for religious organizations as far back as 1802.

Freedom From Religion Foundation co-president Annie Laurie Gaylor, who lost a previous challenge to the allowance in 2014, reacted: “The housing allowance is so clearly a handout to churches and clergy, and it so clearly shows preferential treatment and discriminating in favor of ministers.”

Luke Goodrich, vice president and senior counsel at Becket, said the tax code treats ministers the same as hundreds of thousands of non-religious workers who live in tax-free housing. Goodrich said the court “rightly recognized that striking down the parsonage allowance would devastate small, low-income houses of worship in our neediest neighborhoods and would cause needless conflict between church and state.”

Chief executive officers of nearly 40 denominational benefit programs – including American Baptist Churches USA and the Southern Baptist Convention – filed a friend-of-the-court brief last April urging the appellate court to leave the clergy housing allowance in place.

Russell Moore, president of the SBC Ethics and Religious Liberty Commission, called Friday’s decision “a huge win for religious liberty and church/state separation.”

O.S. Hawkins, president of GuideStone Financial Resources of the Southern Baptist Convention, said he expects challenges to the clergy housing allowance to continue.

“We are thankful that the Seventh Circuit sided with a host of legal experts that the housing allowance allows churches of all types to best provide for their pastors’ needs without favoring any one over the other,” Hawkins said March 18. “We will continue to monitor future cases and stand ready to advocate alongside our Southern Baptist family and alongside a coalition of large and historic pension boards for the benefit of the pastors we are privileged to serve and, indeed, pastors throughout this country.”

Previous stories:

For second time, federal judge strikes down tax break for clergy