Cheerful-looking envelopes from the Georgia Baptist Mission Board that dropped in the mailboxes of nearly 200 retirees in mid-September appeared to contain good news. They depicted a senior-adult couple sitting on a park bench.

The envelopes presented an assumed message: The couple were enjoying the Good Life one or the other — or both — had earned through years of faithful service to the largest and one of the most financially stable Southern Baptist state conventions east of the Mississippi River.

But when those retirees opened their envelopes, they received anything but good news. A one-page impersonal letter — sent by certified mail — informed them their previously promised lifetime medical benefits were being eliminated with 90 days’ notice.

That message repeated four times in bold type. The letter contained no word of appreciation for years served and no explanation for the decision. No condolences. And, at the bottom, no signature of anyone in the convention’s executive office.

Numerous retirees who received that letter said it was as cold and impersonal as might be expected from a secular corporation, rather than from an affiliate of one of the nation’s largest Christian faith groups.

A second page, from the human resources office, announced a forthcoming meeting to explain how to purchase marketplace insurance options, along with an email address and phone number. It also included a copy of the document eliminating their insurance benefits, approved by the Georgia Baptist Mission Board’s Executive Committee. And it provided information about insurance options available through GuideStone, the Southern Baptist retirement and insurance corporation.

The packet did note that retirees would be receiving one final check for 2022 which will be mailed in December. The last payout will be used to help them secure coverage and ease the transition to a new plan. But the absence of condolences for this life-threatening action stood out painfully to the surprised retirees.

The letter contained no word of appreciation for years served and no explanation for the decision. No condolences. And, at the bottom, no signature of anyone in the convention’s executive office.

Just days before, the Georgia Baptist Mission Board Executive Committee voted overwhelmingly to defund the group of senior adults — many in their 80s and some in their 90s — following a recommendation from its Administration Committee.

With one vote and minor discussion, retirees felt, Georgia Baptists broke a moral contract. Only a handful of Executive Committee members asked questions or spoke against the decision.

It was a historic step for the governing body to take, especially with no administrator explaining why. With the new policy, Georgia became the only known Baptist entity to negate promises made nearly three decades ago.

To be sure, secular and nonprofit agencies have been scaling back retiree benefits as the nation’s health care crisis escalates. Decades ago, the Georgia convention covered 100 percent of health care, but it slowly scaled back that generous policy.

According to the most recent audit, in January 2020, the GBMB changed the funding of its age 65 retiree costs from its self-insured plan to a Medicare Supplement plan. More recent retirees continued receiving an annual stipend of around $3,500, based on years of service, which they used to subsidize any policy they chose on the open market.

But for decades before, each group of retirees was assured — if not in writing, then through a verbal understanding — the benefits always would be there. That sacred trust kept some working until they reached that threshold.

But for decades before, each group of retirees was assured — if not in writing, then through a verbal understanding — the benefits always would be there. That sacred trust kept some working until they reached that threshold.

And it motivated those who opted for voluntary retirement in December 2020, understanding they would be the last wave to receive any support. Unfortunately, that group’s health care benefits lasted a mere 12 months.

But the GBMB was honest with each group of retirees as benefits were scaled back. A word to the wise encouraged staff to fund their retirement savings adequately to shoulder more of their own health care expenses.

Twenty-year retirements common, 30 years not unusual

Today, an individual who retires at 65 has a 76 percent chance of living 10 more years, a 38 percent chance of living 20 more years and a 5 percent chance of living another 30 years. In a GuideStone webinar in January, a representative told participants men have an average lifespan of 84 years, while women tend to live to 86. Some, such as at least three known Georgia Baptist retirees, make it into their 90s.

Chronic illness takes over the longer a retiree lives, and that’s when affordable health care insurance is especially valuable.

Shuford Jones is one of many retirees who is being put into a tailspin by the Executive Committee decision. In 2001 in perfect health, he and about 30 other employees were offered an early retirement package. The convention had fallen on hard times after 9/11, and it needed to reduce overhead.

Although he wanted to work a few years longer, Jones agreed the offer of lifetime health insurance through the convention’s group plan for him and his wife was a fair deal.

“I decided to give them four years of future salary in exchange for that benefit. That would be our contribution to helping them balance the budget,” Jones explained. “We did not receive anything else in this arrangement, including the cash retirement bonus, but that was part of the deal. I accepted the offer.”

Almost 20 years later, he believes he had the rug pulled out from under him and his wife, Ann.

“Now, we are at the point in life with poor health, but we planned for it by taking early retirement,” Jones said. “I am 82, and Ann and I both have serious health concerns with chronic illnesses driving up health costs. Now that we need the coverage more than any time in our life, our Georgia Baptist benefits are being taken away.”

It’s easy to see the financial loss the couple took by accepting the deal. Not only did they give up four years of future salary and matching contributions to their retirement plan, but four years of compounded growth to that plan.

“I’m not stretching the truth to say that the health insurance benefits we received from Georgia Baptists have kept us both alive,” Jones said. “Georgia Baptists have always protected us retirees through the lean and fat years; I don’t understand why they cannot find the resources now, especially just six months from selling the debt-free headquarters building with the millions of dollars they will receive.”

Not only married couples feel betrayed. Many single women and widows with restricted income were counting on their promised benefits being honored.

A new broom sweeps clean

New administrations understandably desire to reorganize staff and set new priorities. But if the GBMB’s Executive Committee was not forthcoming with retirees regarding the need to eliminate benefits, the implied language of the executive office was clear.

Since Thomas Hammond took the helm in January 2019, the messaging was ominous. Within two weeks of becoming executive director, after affirming staff and assuring them their future was bright as part of the new team, the first staff reduction began. In two years since, three more have been implemented.

In one of the larger reductions, in September 2020, 49 out of 140 staff — or 35 percent — were offered voluntary retirement incentive packages, The Alabama Baptist reported. Employees who remained after Dec. 31 lost all future retirement benefits. Twenty-six employees took the offer, according to Baptist Press. The package was the last to include retiree benefits, although nothing of permanence was put in writing.

As of late October, full-time staff had been reduced from 172 to 74, with the majority of those reductions occurring “over the past 12 months,” Chief Operating Officer David Melber reported.

That 57 percent reduction easily eclipsed the record of any Baptist state convention since September 2015, when Tommy Green, the new executive in Florida, eliminated 47 percent of staff in one day. That reduction trimmed the Florida convention’s employees from 115 to 61.

Melber, who joined the Georgia administration in 2020, would not rule out future cutbacks, although he said the Mission Board was getting “relatively close” to the right staffing level. He added leadership was not looking at a specific headcount as much as a blend of full-time, part-time and contract workers.

A death by a thousand cuts

Georgia, like many state Baptist conventions, has undergone a series of budget struggles and staff reductions as contributions from churches have dropped. But Hammond has traveled the state laying much of the blame at the feet of the previous 25-year administration — and a drop in giving from churches, as well as the pandemic.

In the summer of 2020, as the pandemic shutdown hit its height, the GBMB furloughed staff and scaled back retirement contributions. Those not furloughed took a 5 percent salary reduction, which remains in place today. Some furloughed staff eventually took positions at less salary.

But later that year, in his address to the fall Executive Committee meeting, Hammond cited losses over a 20-year period associated with the upkeep of multiple convention-owned properties, including the GBMB Missions and Ministry Center. He also added “camps, colleges, and The Christian Index” newspaper as part of the “consistent cash overspend for nonbudgeted items.”

He also acknowledged a significant decline in receipts to the Cooperative Program, the giving channel that largely funds the convention.

When asked in late October what should or could have been done differently, Melber said he preferred not to play armchair quarterback, but the convention no longer had the assets to operate in the old manner. He also noted cash reserves had been spent down by the time the present administration arrived, but reserves are being replenished and now are healthier.

When asked why the GBMB needed to eliminate retiree benefits, he said it was responding to the vote of the Executive Committee. He confirmed the decision would save between $700,000 and $1 million per year.

Selling assets to raise cash

Several properties totaling nearly $6 million have been sold off to stem the convention’s losses. The historic Georgia Baptist Conference Center at Toccoa sold for $1 million in December 2020. The Pinebloom estate in Decatur, briefly home of The Christian Index, sold for $4.2 million. In addition, land adjacent to Baptist Village in Waycross was sold to the senior citizen housing facility, along with a parcel in Norman Park. A tract of land known as the Harbin Estate in Gwinnett County sold for $790,000.

Sale of the convention’s own headquarters building, constructed 15 years ago, is scheduled to occur in April 2022 for an undisclosed price.

The Executive Committee hired one of the nation’s largest real estate brokers, JLL, to market the property late last year. It sold in short order to JLB Partners, which plans to raze the building and construct a mixed-use project. The site will include about 707 residences and 585 luxury apartments in the $400,000 range.

According to The Christian Index, Melber said, “The unsustainable levels of legacy retiree expenses, personnel benefits, declining CP giving and the effects of COVID-19 all contributed to our current financial crisis.”

On a broader scale, the 20-year period of reported overspending occurred during one of the most financially turbulent eras in modern American history.

The 9/11 terrorist attacks of 2001 stunned the economy. The Great Recession, which began in 2007, launched what the Wall Street Journal has called “the lost decade” regarding returns on investments. According to The Christian Index at the time, Georgia suffered as gravely as almost any area of the country.

But even with the cash infusion from property sales and a $3.2 million loan through the federal Payroll Protection Plan to subsidize salaries and maintain staffing levels during the pandemic, cutbacks have continued.

But even with the cash infusion from property sales and a $3.2 million loan through the federal Payroll Protection Plan to subsidize salaries and maintain staffing levels during the pandemic, cutbacks have continued.

The 2020 cutbacks stand out because, for the first time, retirees joined the suffering. As current staff lost all benefits at the end of 2020, retirees with dental insurance learned those policies were being eliminated. All retirees and spouses lost their small life insurance policies, generally referred to as a burial policy, which ranged from $10,000 to $20,000.

Several older retirees who cannot afford life insurance said they were counting on those policies to bury themselves and to pay any outstanding bills without being a burden on relatives. They said they had not purchased any such policy because their retirement package included that benefit.

Single women, widows especially hard hit

Mary Margaret Willis was 65 when she decided to opt for an early retirement package in 2006. The convention had entered another round of cutbacks and looked to reduce staffing levels and operating costs.

At the time, she felt she was making the right decision, but now she feels betrayed. She will turn 81 on Christmas Eve — with illnesses that require more expensive premiums and medications — and is finding her new reality to be a bad dream.

“They have really created a mess for us older people as we try to navigate through all of this. I know some retirees who don’t even have a computer, and you must be computer literate to go to all these websites.”

“They have really created a mess for us older people as we try to navigate through all of this. I know some retirees who don’t even have a computer, and you must be computer literate to go to all these websites,” she explained. “How are they going to get through this? I have spent hours and still don’t have the answers I need.”

Willis is the kind of employee who helped build the Georgia Baptist Convention. As an administrative assistant and single woman, she diligently performed her responsibilities in music ministries. For a quarter century, she was affectionally known as the “den mother” for the Sons of Jubal, a 250-voice male choir. She typified many female staff, whose work ethic and efficiency enabled their male colleagues to stay on the field and serve churches directly.

She was so committed to music ministries, she returned as a volunteer another 14 years. She never doubted the convention was just as committed to her.

Now she struggles with finding affordable health insurance. It is a particular concern to the majority of women who have served Georgia Baptists who are single or widows.

“It may come as a shock to some, but Medicare does not cover all your health concerns,” she said. “Retirees have to purchase supplemental insurance to cover the 20 percent that Medicare does not pay, and another policy to cover your prescriptions.

“It can get expensive very quickly, especially when you are on an increasingly restricted income 20 years into your retirement.”

“It can get expensive very quickly, especially when you are on an increasingly restricted income 20 years into your retirement.”

Premiums can be astronomical due to chronic illness and medications that do not offer generic options. Premiums vary by county, with some counties having only one provider. With no choice, retirees have to pay what they are offered.

Some retirees will have to stop taking $10,000 injections because insurers will not cover the costs. Some will be at the mercy of pharmaceutical makers to provide them free of charge — if they qualify and can manage the application process.

In Willis’ case, due to her health needs, the popular and more affordable Medicare Advantage plan will cost $4,000, plus $3,600 annually for her co-pay obligations. That is nearly $8,000 annually, which she will have to absorb amidst rising inflation and shrinking savings.

Gwen Newman never worked directly for Georgia Baptists, but her husband, Ray, was prominent in planning the annual meetings and through his service in public affairs. After his death in 2013 at age 68, Truett McConnell University named a lectureship in his memory.

She acknowledges that while she never was on the payroll, she did receive benefits her husband earned that were supposed to continue beyond his death. She was shocked when she learned about the convention’s action from one sentence in a Baptist Press news story.

She was shocked when she learned about the convention’s action from one sentence in a Baptist Press news story.

The certified mail she received the next day spelled out the details.

“The letter threw me into quite a tailspin,” Newman said. “I am facing knee replacement and will now have a far larger copay than I expected, if I can decide which plan I need to purchase. Ray was always the one who made these decisions, and now this puts a lot of worry and concern on my plate.”

Fellow retiree and neighbor Shuford Jones sympathizes with her plight.

“I know for a fact that Ray died believing that Gwen would be taken care of by Georgia Baptists,” he said.

Great Recession, Great Commission Giving compound financial problems

Baptists commonly know that reduced contributions from churches have presented budget-balancing challenges to state and national denominational organizations. But the economic conditions that led to Georgia’s problems also impacted other state conventions when the Great Recession hit in 2007 — well within the 20-year window Hammond cites for his current budget problems.

Georgia’s sister conventions also felt the pain. In 2009, in the depths of the economic collapse, The Christian Index noted the North Carolina Baptist convention reported a budget shortfall of 11.4 percent, Florida a loss of 9 percent, Tennessee 7.7 percent and South Carolina 6 percent. Georgia was in the middle with 8.2 percent, and Alabama had no change.

Just two years into the recession, Southern Baptist messengers in 2010 approved a plan called Great Commission Giving, which blessed church contributions to any Southern Baptist missions causes outside the established Cooperative Program unified budget distribution. A growing number of pastors now use that structure to reduce Cooperative Program giving to their state convention in order to fund other specific missions enterprises.

After a contentious SBC annual meeting in Nashville this summer, more pastors are viewing Great Commission Giving as an effective way to designate around denominational entities with which they disagree.

After a contentious SBC annual meeting in Nashville this summer, more pastors are viewing Great Commission Giving as an effective way to designate around denominational entities with which they disagree. Some believe that is occurring in Georgia as it struggles with declining giving.

The years between the Great Recession and the launch of Great Commission Giving sent Georgia scrambling to reduce staff and cut operating costs. A documented slide in national Cooperative Program giving also trimmed the state budget from a record $49.5 million in 2007 to $37.8 million in 2020, a decline of $11.7 million, or 23.6 percent.

The Georgia convention tapped reserves to help its colleges stay afloat and especially to fund conference centers, as happened during the pandemic under Hammond. The Georgia Baptist Conference Center at Toccoa lost hundreds of thousands of dollars when all large meetings, summer camps and retreats were cancelled in the pandemic shutdown.

But during all that decade of cost cutting, retiree benefits remained untouched. And they remain uncut in all other similar state conventions.

Neighboring states see rebound after COVID, keep retirees whole

In such uncertain times. Georgia’s budget has been hit harder than its neighbors’.

The 2019 budget, the first to be inherited by the current administration, was an optimistic 1.6 percent higher than the previous year, at $40.39 million. Each year since has shown a decline.

The 2020 budget — the year of COVID and shutdowns — took a 6.7 percent cut to $37.8 million. With two months to go, the 2021 year-to-date budget shows a deficit of nearly $9 million; only $28,850,000 is projected to be received from the budgeted $37.8 million.

In Georgia, the final two months of the year typically show a “catch up” period as churches close out their books and make up for the summer vacation slump. But a 24 percent decrease, observers say, might be hard to cover.

Next week messengers at their annual meeting will be asked to approve a 2022 budget of $36,699,950 — a decrease of 3 percent from the current $37,835,000.

With that in mind, next week messengers at their annual meeting will be asked to approve a 2022 budget of $36,699,950 — a decrease of 3 percent from the current $37,835,000. That will culminate in a $12.8 million — 25 percent — decrease from the high of $49.5 million in 2007.

A recent survey of several states surrounding Georgia shows all conventions have made budget cuts of varying degrees since 2019 — the year prior to the national shutdown. But some have fared better and are reporting Cooperative Program receipts for 2021 of as much as $1 million over the previous year. None have reported cutting or eliminating retiree benefits.

In Mississippi, Financial Services Director Paul Pinson said the convention has “been very pleased that the impact from COVID has been very minimal.” In the heat of the 2020 national shutdown, CP giving only dropped $433,708, or 1.38 percent, to $31,044,999.

“Thus far, things are looking exceedingly good for our budget,” he said. “We have been very blessed and thankful for the support we have received from our churches.”

In spite of the pandemic, Mississippi Baptists have made “no policy changes to our retiree benefits,” Pinson said. “Those commitments remain solid and have not been affected.”

In Louisiana, CFO and Associate Executive Director Dale Lingenfelter, noted Cooperative Program receipts have been a different story. The convention has met its budget only once in the last dozen years; since 2008 a total of $5.25 million — or 23 percent — has been trimmed from the budget.

Yet despite the lean times when staff reductions occurred only through attrition, retirees did not shoulder any of the shortfall. In 1995, Louisiana Baptists approved elimination of all future retiree benefits, but existing recipients were protected. They continue to receive medical insurance through a Medicare Advantage Plan, paying $79 monthly premiums, which are reimbursed by the business office.

Lingenfelter noted most of the convention’s 82 retirees and their spouses are in their mid-80s and 90s.

“We feel a tremendous obligation to take care of our retirees,” he added. “They have made so many sacrifices through the years, and it’s the right thing to do.”

Mike Gilley, who works in accounting for the Florida Baptist Convention, said the state “has not experienced any downsizing through the COVID era and only suspended retiree benefits for a couple of months during the worst of the downturn.” The convention fully restored those in short order.

Tennessee’s William Maxwell said the convention adjusted retiree benefits in 1993, which put it on a path to financial stability. That’s when it created a transition that, first and foremost, fully protected older recipients; then offered a voluntary retirement package with a scaled-back medical plan for those who retired by early November; and then eliminated benefits for remaining and future employees.

Maxwell said the Tennessee convention’s leaders believed this was the most equitable solution to all three employee categories that protected the neediest of the group — about 70 older retirees — while giving those still employed time to make financial decisions for their own health care. Cooperative Program support from churches has been encouraging, he added.

“The depth of the downturn in 2020 resulted in only a 1.5 percent drop, and current receipts are up 2 percent thus far in 2021,” Maxwell said. “We had several churches tell us they were not spending as much in 2020 as they scaled back due to the national shutdown, yet their tithing remained surprisingly strong. They simply forwarded some of that overage to the Mission Board.

Chad Austin, editor and public relations coordinator for the Baptist State Convention of North Carolina, reported strong Cooperative Program receipts. The convention operates on a calendar year that closes Dec. 31.

For 2021, Cooperative Program giving totals are on track to end “somewhere between $28 million and $28.5 million, which would exceed the current budget by nearly $1.5 million,” he said. “Messengers at our annual meeting in November will consider a $28 million budget proposal for 2022, which would reflect an increase of $1 million over the current budget of $27 million.”

Through Sept. 30, “giving to all special offerings are also up double-digit percentage points when compared to year-over-year,” he said.

In South Carolina during the worst of the pandemic, 2020 Cooperative Program receipts were down only 2.1 percent, or $566,410, according to the convention’s website. Year-to -date totals through September 2021 show a slight increase of $127,797, or up 0.7 percent.

Chief Financial Officer Bryan Holley reported the state has not reduced benefits for its 76 retirees, although it has followed other states in reducing benefits for future employees.

The Alabama State Board of Missions did not respond to a request for information.

Ministry Center caught in cross hairs

In Georgia, Hammond has not spared the state convention’s headquarters building from his criticism of the previous administration. He frequently has said selling the structure would be one of his top priorities.

The site of the facility was cobbled together from several tracts in what has become a prime location on Sugarloaf Parkway in Duluth, just northeast of Atlanta. It is located across the street from Gwinnett Center, which includes a convention center and the Gas South District Arena sports and entertainment complex.

Nearly 1 million people annually attend events at the site, so the Baptist Missions and Ministry Center, as the building is called, frequently shortens working hours to allow staff to leave before the traffic jams.

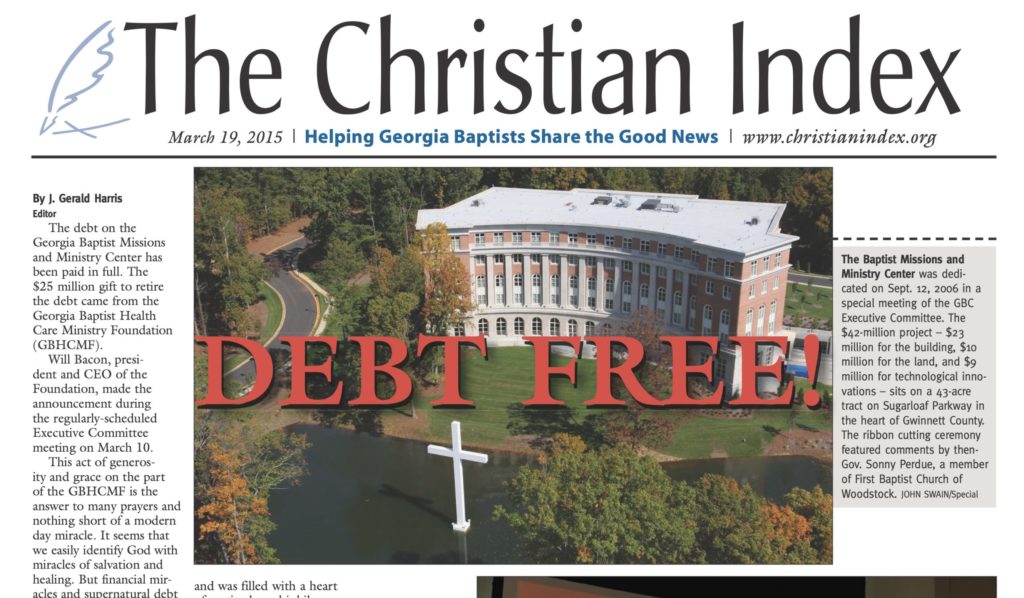

The building, sitting on 43 acres, was constructed for $42.3 million and has increased in value since it was occupied in 2006. In 2015, a gift from the Georgia Baptist Health Care Ministry Foundation paid off the remaining $25 million debt.

The property’s value was estimated to be nearly $65 million shortly before plans for a development across the street collapsed. The national COVID shutdown further depressed prices in the area. But even if the value fell by as much as $10 million, observers say, the market has bottomed out and is slowly turning around.

A nearly $8 million return on a $42.3 million investment would be a generous profit for Georgia Baptist shareholders — the men and women in the pew — who supported its construction. That estimate would be based on a $50 million sales price.

In time, the property could appreciate by at least another $5 million, strictly due to its prime location, observers say. And it might sell without a listing, saving significant fees.

Across the years, the building has not been popular with many Georgia Baptists. Some say the former administration spent too much on furnishings, and the prior building could have been retrofitted for far less.

To put its origin in context, the building — which Hammond jokingly refers to as the Taj Mahal — was planned over several years of economic affluence and strong Cooperative Program giving. The convention’s Administration Committee and Executive Committee, its highest governing bodies, approved construction. And messengers voted their approval in four consecutive annual meetings.

Even some critics of the building’s aesthetics note it is in poor taste to continue blaming previous leaders three years into the new administration’s tenure. If one administration went too far in spending, they say, the next has gone too far too fast in cutbacks.

The building’s construction occurred in an era when churches embarked on a similar building boom, which included family life centers with gymnasiums, as well as multi-million-dollar sanctuaries that were larger and more grandiose than the buildings they replaced. The Christian Index frequently profiled churches that included relocations and outsized campuses and buildings.

Even some critics of the building’s aesthetics note it is in poor taste to continue blaming previous leaders three years into the new administration’s tenure. If one administration went too far in spending, they say, the next has gone too far too fast in cutbacks.

For many, eliminating retiree benefits is one step too far.

A vote that unintentionally sealed the fate of retirees

Many retirees have voiced concern about how Hammond can say times are hard and cuts are necessary, but then become upbeat about the forthcoming sale of the debt-free structure.

In the November 2019 annual meeting, messengers approved a report from an ad hoc study committee that supported Hammond’s plan for investing the profits. According to The Christian Index, 75 percent of the proceeds would “be set aside in an endowment for strengthening churches, encouraging pastors and pushing back lostness in Georgia and around the world.”

The remaining 25 percent was earmarked to relocate staff offices and construct a new, far smaller office building.

“This will be an investment over the years of millions and millions of dollars for kingdom work,” Hammond explained. “The proceeds from the money endowed will be used in a variety of ways to serve our pastors and churches until Jesus comes back.”

That vote on how to spend the windfall indirectly sealed the fate of retirees when the administration later decided Cooperative Program funds are not available to provide benefits. The convention committed funds from the property sale to specific ministries, and that decision cannot be amended without another vote.

That vote on how to spend the windfall indirectly sealed the fate of retirees when the administration later decided Cooperative Program funds are not available to provide benefits.

When questioned why the administration chose to stop funding the retirees, Melber said it was only responding to the vote from the Executive Committee. He directed any further inquiries to the members of the committee, headed by Chairman Tommy Fountain.

When questioned on the topic, Fountain, said: “It’s been a very difficult three years for us. An audit showed that we were not financially solvent and that, combined with the decline in Cooperative Program and the pandemic … well, it was the perfect storm.

“We love our retirees but feel we had to make this decision, along with other hard decisions, to return us to a place of solvency. Thomas has been extremely transparent and has been honest about trying to get us back to where we can be more effective in ministry.”

Strange turn of events in a budget crisis

During the 2022 planning process, funding for both Pastor Wellness — one of Hammond’s new and highly worthwhile ministries — and the retirees both got cut from the Cooperative Program budget. But in a turn of events, the Georgia Baptist Health Care Ministry Foundation provided a nearly $2 million grant to fully fund Pastor Wellness.

The one-time block grant, which can be renewed annually, doubled the budget of Pastor Wellness from $829,652 to $1,759,911. And it doubled the amount of any grant issued in the foundation’s history. Additionally, the new money totaled about $900,000 — nearly exactly the amount that could have been allotted to save retiree benefits.

If the foundation does not renew the grant, Pastor Wellness could once again be defunded and at the mercy of budget planners to come up with Cooperative Program support.

An Oct. 29 email from Assistant Executive Director Mark Marshall underscored the importance of Pastor Wellness. He said, “Along with Church Strengthening, Pastor Wellness is one of the two main rails of the GBMB ministry.” That hints at why that ministry won out over retirees.

The grant to Pastor Wellness is “within our lane,” foundation President Larry Wynn said. “We believe we must have healthy pastors, and this is one way we can help with that. When Baptist Hospital existed downtown, they did a wonderful job of keeping pastors healthy; we want to keep that commitment.”

But others ask: Who is keeping their commitment to the retirees?

When asked if the foundation would consider helping retirees with a similar grant, Wynn said that was “not something we have looked at. We are providing funds for pastor health (through the Pastor Wellness ministry) so they can serve churches better, but we have never provided funds for salaries or retirement benefits.”

While Wynn is technically correct, that will change with the 2022 budget, which earmarks $694,059 of the Pastor Wellness grant for personnel, which normally is interpreted as salaries — in this case staff salary and benefits. That would break new ground for the foundation.

Another $91,200 is budgeted for travel and $145,000 for program fees. Traditionally, foundation grants have been designated strictly for providing a variety of free or low-cost medical services; the requesting agencies provide staff and infrastructure.

Any theoretical future grant for retirees would not provide salaries because retirees have their own income through retirement funds they saved through GuideStone and through Social Security. What they lack now is health care coverage.

Some retirees could join the under-insured

A large portion of the foundation’s grants support community health fairs, dental clinics and other outreach by congregations serving the uninsured and underinsured. An unintended result of retirees being defunded could place aged retirees standing in lines at health clinics for free dental services, eyeglasses, donated medicine or referral to government welfare agencies.

Such a scenario is not about being destitute but being unable to afford high insurance premiums that come with chronic illnesses. Many of the nation’s under-insured have jobs, just not affordable insurance. Many retirees have neither.

Ironically, retirees who are former pastors would not be eligible for the Pastor Wellness benefits — such as the annual health clinics — because they are not active ministers. And if they were grandfathered into the program, not including their wives or widows would be awkward.

Another complicating issue would be whether to exclude retired single women, since Southern Baptists do not allow them to serve in pastoral roles.

Phil Pilgrim, a recent retiree, served as a Georgia pastor, convention vice president, member of both the Nominating Committee and Executive Committee, and state missionary. He says the retiree cuts are unprecedented nationally and fears it could set a precedent for other states to follow Georgia’s lead.

“They have used people in the prime of their lives and have eaten out the good center and thrown away the wrapper. They see no moral, ethical or spiritual problem in breaking promises made to retirees simply because, they rationalize, they did not make those commitments.”

“It seems that the board now sees retirees as an old candy bar,” he said. “They have used people in the prime of their lives and have eaten out the good center and thrown away the wrapper. They see no moral, ethical or spiritual problem in breaking promises made to retirees simply because, they rationalize, they did not make those commitments.”

Pilgrim sees many biblical comparisons between what has happened to women like Willis in music ministries being single and Newman, as a widow.

“There are many passages in the Bible about our obligation to care for our parents and the elderly, for the widows and orphans,” he explained. “Jesus admonished those who supported the temple with their offerings but neglected their own parents.

“I feel that at this time in our history we are like the mythological Dullahan from Irish folklore. It’s a tale about an entity with no head who rides off in any direction that it wants to go at the moment. By their overwhelming vote, the Executive Committee, representing the churches, chose to ride off and ignore Christ’s teachings and our foundational beliefs.

“How can they say that we, as Georgia Baptists, are ministering to the needs of society while turning a blind eye to those within our own family? It’s not just about What Would Jesus Do, but how would he do it?”

Joe Westbury is a veteran Baptist journalist based in Atlanta.

Related articles: