On the eve of COP26, the United Nations’ climate conference scheduled for Oct. 31-Nov. 12 in Glasgow, Scotland, news outlets are focusing on potential actions by world governments to reduce emissions causing the global climate crisis. Less known to the public and even to church members themselves are the ways that United Methodist-related bodies have been working for years toward curbing climate change.

Despite growing interest in and support for a theological understanding that humans must step up to care for creation as God commanded in Genesis, United Methodists remain of two minds about whether divestment or sustainable investing is the better tool for making a “green economy.”

Fossil Free UMC

A movement called Fossil Free UMC formed in 2013 to encourage United Methodists to join the global divestment campaign. The Methodist Federation for Social Action describes it as “a movement of United Methodists who recognize that it is wrong for The United Methodist Church to profit from wrecking the planet. Indeed, profiting from fossil fuel companies undermines the very ministries that our investments are meant to support.”

Fossil Free UMC also urges adding “coal, petroleum and natural gas to the list of socially responsible investment screens” in the Book of Discipline, the collection of UMC laws and policies, and the Book of Resolutions, the collection of social aspirations.

“The question came down to divestment vs. engagement as the better way to use church investments in influencing energy companies to address climate change.”

In an effort to accomplish fossil-free goals at the last General Conference held in 2016, delegates debated passionately for two hours about a proposal to have Wespath, United Methodists’ pension and health benefits agency, screen out investments in fossil fuels. As Sam Hodges wrote for UM News at the time: “The question came down to divestment vs. engagement as the better way to use church investments in influencing energy companies to address climate change.” The divestment measure was voted down “overwhelmingly,” Hodges wrote.

In the five years since then, however, science has confirmed that the climate emergency has reached a critical point and that human activity is both the cause of global warming and a cure for it. United Methodist groups such as EarthKeepers and the UMC Creation Justice Movement have emerged to take climate care education and action to local churches. Yet the debate continues over whether fossil-fuel divestment or sustainability investing represents the denomination’s best approach to enacting its theology of creation care.

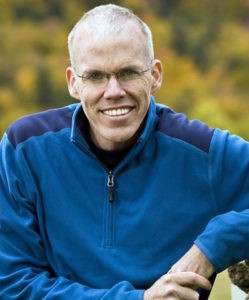

Bill McKibben

United Methodist layman Bill McKibben — considered one of the “godfathers” of contemporary climate activism — promotes fossil fuel divestment. Author of the 1989 book The End of Nature, that sparked renewed climate activism, McKibben provided a snapshot of the current state of fossil-fuel divestment in an Oct. 26 essay in the New York Times, “This Movement Is Taking Money Away From Fossil Fuels, and It’s Working.”

Bill McKibben

McKibben wrote: “On Tuesday (Oct. 26), a little less than a week before the start of the United Nations climate conference in Glasgow, activists announced that the fossil fuel divestment campaign has reached new heights. Endowments, portfolios and pension funds worth just shy of $40 trillion have now committed to full or partial abstinence from coal, gas and oil stocks. For comparison’s sake, that’s larger than the gross domestic product of the United States and China combined.”

He continued: “The battle to wind down the fossil fuel industry proceeds on two tracks: the political (where this week may or may not see action on big climate legislation from Congress) and the financial. Those tracks cross regularly — the influence of money in politics is clear on energy legislation — and when we can weaken the biggest opponents of climate action, everything gets easier. Divestment has helped rub much of the shine off what was once the planet’s dominant industry. If money talks, $40 trillion makes a lot of noise.”

Progress despite the failed vote

While the 2016 effort to get the entire church to sell off its fossil-fuel investments failed, divestment has spread throughout other UMC and international Methodist entities. For example, the Pacific Northwest Annual (regional) Conference maintains a page of resources for local churches to study divestment, a goal adopted by the unit in 2015. Last year UMC-related American University in Washington, D.C., announced it sold the last of its public fossil fuel investments from its endowment, eliminating “the remaining $12.9 million of fossil fuel exposure within the public endowment portfolio.” Earlier this year, the British Methodist Church’s central financial agency announced it had divested from all fossil-fuel business, a development that made major news in the United Kingdom.

Divestment has spread throughout other UMC and international Methodist entities.

Wespath, the UMC’s official investment agency for clergy pensions and health benefits, stands firmly in the engagement camp. The agency ranks as the world’s largest nonprofit investment manager, administering some $28 billion in assets.

Wespath recently issued a report on its sustainability investing for the period 2019 and 2020. The report takes into account the transforming impact of the worldwide coronavirus pandemic on investing. The report’s introduction states: “At Wespath, we organize our sustainable investment activities through our sustainable economy framework and its three core pillars: long-term prosperity for all, social cohesion and environmental health. We use a set of actions — invest, engage and avoid — to ensure we are proactively contributing to the sustainable economy framework.”

Barbara A. Boigegrain speaks to the climate proposal at the UMC’s 2016 meeting. (Photo: UM News)

In keeping with this strategy, some 8% of Wespath’s total assets are invested in low-carbon solutions to address climate change, says the report. Additionally, Wespath has invested $57 million in sustainable agribusiness strategies, a response to research showing that industrial agriculture contributes to global warming particularly through methane emissions. The effects of methane on the environment have been documented recently to be a factor in the greenhouse effect of global warming even greater than carbon dioxide emissions.

Outgoing Wespath executive Barbara A. Boigegrain, who retires this year, commended the agency’s strategy in her report: “The success of our work on climate change, affordable housing, and many other collaborative, responsible and impact investing initiatives gives me great confidence that we are on a path toward a brighter future — where equal opportunity, reliable access to basic necessities and resilient ecosystems are recognized and supported by investors as foundations for a sustainable, equitable world economy.”

Wespath’s chief investment officer, Dave Zellner, echoed Boigegrain in the report: “In addition, our sustainable economy framework guides our understanding of how the world economy will change. As hockey legend Wayne Gretzky advised: ‘Skate to where the puck is going, not to where it has been.’”

As the world watches the developments of COP26, Methodists seem to be successfully pursuing both divestment from fossil fuels and sustainable investing in alternative businesses as tools to help bring about global economy that supports a cleaner, safer environment.

Related articles:

Christians and climate change: A chance to take the Bible seriously | Analysis by Chris Conley

On climate change, the political divide has widened as more Americans overall express concern

Climate change is heating up the terrorist conflict in Africa’s Sahel region

I wrote about climate change; now I’m hearing from mean Christians | Opinion by Susan Shaw