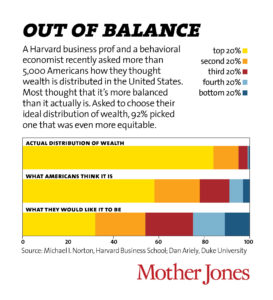

In November 2012, a YouTube user known as “politizane” created a viral video about wealth inequality in America that animates research conducted by Dan Ariely and Michael L. Norton using a series of graphs produced by Mother Jones magazine.

Ariely and Norton found the reality of wealth inequality in America differs sharply from what most Americans think it is or believe it should be. At the time, the richest 1% of Americans controlled 40% of the nation’s assets, while the bottom 80% (4/5 of all Americans) possessed only 7% combined.

In the intervening years, this wealth gap has continued to widen — despite a robust economy between 2012 and 2020 — because the lion’s share of profits and benefits continue to flow upward to company shareholders and office holders at the top of the corporate ladder. The 2021 edition of the Forbes 400, ranking the 400 richest people in America, the richest of whom also are the richest in the world, captures the extent of this disparity.

In the intervening years, this wealth gap has continued to widen — despite a robust economy between 2012 and 2020 — because the lion’s share of profits and benefits continue to flow upward to company shareholders and office holders at the top of the corporate ladder. The 2021 edition of the Forbes 400, ranking the 400 richest people in America, the richest of whom also are the richest in the world, captures the extent of this disparity.

The numbers are staggering. Inclusion on the Forbes 400 list now requires a minimum net worth of $2.9 billion, a record. For the first time, a man whose net worth exceeds $200 billion tops the list — Amazon’s Jeff Bezos, who holds the No. 1 spot for the fourth consecutive year. Together, these 400 individuals control a pool of assets worth $4.5 trillion, another record.

Wide gap — even at the top

Even here, however, on the slopes of capitalism’s Everest, the difference between base camp and the summit is exponential.

The 20 individuals who lead this year’s list possess a collective net worth of $1.8 trillion, or 40% of the Forbes 400’s net total. That’s a magnitude of financial capital greater than the annual GDP of Canada, a G7 nation with a population of 36 million people.

In 2020, only two of this exclusive group owned assets worth more than $100 billion; now eight do. The top three (Bezos, Elon Musk and Mark Zuckerberg) have more than $500 billion to themselves. By comparison, median U.S. household wealth clocks in at around $122,000.

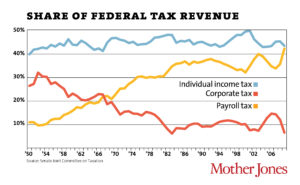

Such vast wealth disparity — the most extreme among the G7 nations — has been building in America since the 1980s and is the direct result of economic policies that have deregulated businesses, gutted social safety nets and cut taxes for the wealthy.

Working better, earning less

All the while, worker productivity in the United States has continued to increase; yet U.S. workers no longer share in the abundant fruits of their labor. Real wages for non-management U.S. employees have not increased for more than 40 years. The Pew Research Center’s Drew DeSilver sums up the situation:

Such vast wealth disparity has been building in America since the 1980s and is the direct result of economic policies that have deregulated businesses, gutted social safety nets and cut taxes for the wealthy.

After adjusting for inflation … today’s average hourly wage has just about the same purchasing power it did in 1978, following a long slide in the 1980s and early 1990s and bumpy, inconsistent growth since then. In fact, in real terms, average hourly earnings peaked more than 45 years ago: The $4.03-an-hour rate recorded in January 1973 had the same purchasing power that $23.68 would today (2018).

Of course, this is not how the “Reaganomics” experiment was supposed to turn out. When the Ronald Reagan administration ushered in these policy changes, the benefits granted to management and ownership classes were supposed to “trickle down” to everyone else. The enterprising rich, freed from the restraints of government regulation and the burden of high taxes, would create more and better jobs. Investments into society would flow more easily, and those with business savvy would find wider and more accessible pathways to success. The rising tide would lift everyone’s boat.

Forty years out, the reality pales in comparison to the advertisement. Wealth isn’t flowing down from the top; it’s pooling at the top. The rich aren’t spreading their wealth; they’re hoarding it and then going back for more. Among the Forbes 400, more than one-third — 156 — donated less than 1% of their wealth to charity last year.

Grotesque injustice

Clearly, extreme wealth disparity constitutes a grotesque injustice within American society. Hard-working Americans are struggling to make ends meet, while our country’s richest individuals possess fortunes that rival the treasuries of nations.

Formulating a solution for this imbalance is beyond the scope of this article and above the pay grade of the author, especially given the lack of a clearly defined theology of economics within the Protestant free church tradition. Some dedicated disciples advocate for significant economic reform through government intervention. Other dedicated disciples contend change should be sought through the free market.

Formulating a solution for this imbalance is beyond the scope of this article and above the pay grade of the author, especially given the lack of a clearly defined theology of economics within the Protestant free church tradition. Some dedicated disciples advocate for significant economic reform through government intervention. Other dedicated disciples contend change should be sought through the free market.

One thing that cannot be argued, however, is economic concerns are beyond the spiritual purview of the Christian church. The Bible presents a clear mandate for the practice and pursuit of fairness — justice — in the marketplace as a spiritual discipline for God’s people. We cannot worship God on Sundays and exploit others for economic gain on weekdays (Isaiah 58:1-10; Micah 6:6-12; Malachi 3:5). We cannot privilege the rich within the congregation of the Lord (James 2:1-5) or turn a blind eye to the unsavory byproducts of wealth disparity in the world (Isaiah 10:1-4; Matthew 25:31-46; Luke 16:19-31; James 2:6-7; 5:1-6; 1 John 3:16-17).

How, not if

When faced with the realities of such glaring economic injustice, the question for followers of Jesus in America must always be how we should respond, not if we should respond.

Jesus creates a new relationship between us, God and creation that permeates all aspects of life for the Christian disciple, because Jesus is the head of all things for the church (Ephesians 1:22-23). To love God is to love our neighbors as ourselves. To love our neighbors as ourselves is to desire that they flourish, not simply survive.

At a bare minimum, the dignity of an honest wage for all workers who provide fruitful, essential labor should be both a political and a theological demand that we place on ourselves, our congressional representatives and our corporate leaders.

The excesses of the Forbes 400 are nothing for us to celebrate or marvel at; they are excesses for us to lament and confront.

Todd Thomason is a gospel minister and justice advocate who has pastored churches in Virginia, Maryland, and Canada. He holds a doctor of ministry degree from the Candler School of Theology at Emory University and a master of divinity degree from the McAfee School of Theology at Mercer University. In addition to Baptist News Global, Todd writes regularly at viaexmachina.com. Follow him on Twitter @btoddthomason and Facebook @viaexmachina.

Related articles

Social liberalism grows while economic conservatism still dominates / News, Mark Wingfield

‘What’s mine is yours’ defines ‘kingdom economics,’ New Testament scholar insists / News, Marv Knox

The Bible demands economic justice / Opinion, Miguel de la Torre