Not only are conservative evangelicals seeking to redefine religious liberty to their favor through court rulings, they’re also quietly using a provision of the IRS code to shield their flourishing nonprofit ministries from financial reporting obligations and to aid in their discrimination.

The key to understanding this trend is to focus on the definition of “church.”

The Family Research Council — designated as a hate group by the Southern Poverty Law Center — is the latest in a long list of faith-based nonprofits to declare itself a “church” even though it does nothing resembling the basic functions of a church. It is an advocacy group.

However, the loose definition of “church” allowed by the IRS — and the lack of serious enforcement — has made it possible for all manner of entities that are not churches to claim status as a church or, more specifically, an “association of churches.”

This accompanies a trend of pushing federal and state courts to favor conservative evangelical practice through preferential treatment of the Free Exercise Clause of the First Amendment over the Establishment Clause. This strategy was most recently seen in the U.S. Supreme Court’s highly controversial ruling in Kennedy v. Bremerton School District, where the high court said an assistant football coach should be allowed to lead public prayers on the 50-yard line after games.

That was the most high-profile of a series of rulings over the past three years that have sided with conservative evangelicals who often complain that they are being persecuted for their religious practice. That “persecution,” however, comes from the First Amendment’s prohibition on government “establishing” or favoring any religion over another or over no religion at all.

Billy Graham Evangelistic Association

Franklin Graham (R) talks with President Donald Trump during a ceremony as the late evangelist Billy Graham lies in repose at the U.S. Capitol, on February 28, 2018, in Washington, D.C. (Photo by Ron Sachs-Pool/Getty Images)

The root of the movement to avoid IRS scrutiny of their financial statements begins with a similar premise from conservative evangelical nonprofits. One of the first to take this approach in the current wave was the Billy Graham Evangelistic Association, led by Franklin Graham, who frequently makes political comments from his bully pulpit, including defending Donald Trump’s lies.

In a statement from its public relations firm to The NonProfit Times in 2016, BGEV cited three reasons for seeking reclassification as a “church”:

- The ministry had been operating as an “association of churches” for years.

- There are religious exemptions in the federal tax code that apply only to “associations of churches” and other church organizations, including protections of employers from government interference in matters relating to employment. Three years earlier, the IRS had questioned BGEV and Samaritan’s Purse — also led by Franklin Graham — after they took out newspaper ads supporting a North Carolina constitutional amendment defining marriage as between one man and one woman.

- Filing the annual tax form has become “increasingly onerous, consuming a substantial amount of ministry time and financial resources.”

A license to discriminate

The unspoken reality is that “churches” are allowed to discriminate in hiring and employee benefits in ways that other businesses and nonprofits are not. Rules that were intended to give deference to houses of worship to hire clergy who share their doctrinal beliefs are now being used to allow nonprofits with hundreds of millions of dollars in annual income to discriminate in hiring. That means they can deny employment to LGBTQ persons, to single mothers, to Catholics, to anyone they choose.

“Churches” are allowed to discriminate in hiring and employee benefits in ways that other businesses and nonprofits are not.

And it also means they cannot be required to follow federal law and include contraceptive coverage in their health insurance benefits.

While an organization’s hiring and benefits practices might not have been transparent to outsiders before, the basic financial information was transparent. The IRS requires all nonprofits — except churches — to file an annual Form 990 that discloses income and expenditures, key sources of revenue, and compensation for the highest-paid officials. (Baptist News Global is a nonprofit required to file Form 990 annually, and the latest document is available on our website.)

Through Form 990, any donor or interested person may easily learn about a nonprofit’s financial status and get an idea for how it spends its money. All Form 990s are available for public view on the IRS website and on the websites of other donor-focused sites such as GuideStar.

But that information is not required of churches. Thus, critics of Franklin Graham who believe he receives exorbitant compensation from Samaritan’s Purse and BGEV — reportedly more than $700,000 annually from Samaritan’s Purse alone — have zero access to documentation to prove their case.

It is one thing for a local church not to be required to report the $70,000 annual salary given its pastor, but quite another for a multimillion-dollar nonprofit to be able to shield from donors the $700,000 salary of its president.

Denominational bodies are ‘churches’ too

While the trend of autonomous faith-based nonprofits seeking classification as a church may be new, the practice of denominationally owned nonprofits doing this is well-worn. A lengthy article about the IRS classification of churches in ProPublica uses the Southern Baptist Convention as an example.

All the entities of the SBC are classified as churches by the IRS.

All the entities of the SBC — the nation’s largest denomination behind only Catholicism — are classified as churches by the IRS. That includes everything from the SBC Executive Committee to the two mission boards, to the six SBC seminaries and the Ethics and Religious Liberty Commission.

NAMB headquarters in Alpharetta, Ga.

A small difference is that SBC entities are required by the denomination to file annual financial reports that are published online, while parachurch organizations like Samaritan’s Purse or Family Research Council have no such oversight and make very little financial information public. But the financial reports published by the SBC do not include all the same information required on an IRS Form 990 — specifically, compensation information for leaders.

Lately that has frustrated critics of the SBC’s North American Mission Board, who believe leaders of the Atlanta-based agency are living large on church offerings.

It’s not just the SBC agencies that get to shield such information by being classified as churches; all denominational entities in the U.S. are able to claim the same. It is the parachurch ministries that previously were left out because they can’t claim the cover of a denomination.

Parachurch ministries previously were left out because they can’t claim the cover of a denomination.

Enter ‘association of churches’

The loophole — or open door — they’ve now found is in the phrase “association of churches.”

In a government agency typically ruled by rigid guidelines, the IRS is unusually vague about the definition of a church. Its website explains: “The term ‘church’ is found, but not specifically defined, in the Internal Revenue Code. With the exception of the special rules for church audits, the use of the term ‘church’ also includes conventions and associations of churches as well as integrated auxiliaries of a church.”

The “integrated auxiliaries of a church” is what covers the agencies and seminaries of the SBC and other denominations. That phrase is defined by the IRS as “a class of organizations that are related to a church or convention or association of churches but are not such organizations themselves.”

Here is where nonprofit ministries affiliated with a single denomination have a longstanding advantage over parachurch ministries when it comes to financial reporting requirements. However, it was only in the second half of the 20th century that the idea of a parachurch ministry became commonplace. Before that time — before Campus Crusade for Christ, before Navigators, before Focus on the Family — almost all faith-based nonprofits were owned by denominations.

Still, it is novel for parachurch ministries — which by definition cannot be “integrated auxiliaries of a church” — now to claim they are an “association of churches.”

Both BGEV and Family Research Council cite their partnership with churches as evidence of such a qualification.

In its application to the IRS obtained by ProPublica, the Family Research Council said it has an array of “partner churches” with a shared mission: “to hold all life as sacred, to see families flourish, and to promote religious freedom.”

Family Research Council told the IRS its association of churches is like the early church described in the New Testament.

However, unlike a denomination, there is no set process for a church to become one of the 40,000 partners that make up Family Research Council’s association. Nonetheless, the parachurch ministry told the IRS its association of churches is like the early church described in the New Testament.

Its IRS application explains of the New Testament churches: “Each of these churches operated according to its own internal ecclesiastical structure and was not formally controlled by a higher body. However, these churches associated with each other based on shared beliefs and mission. Any issues were addressed by letters, some of which are included in the New Testament of the Bible, and by visits from the apostles and other early church leaders as recorded in the Book of Acts. If a local church strayed too far, it may have been disassociated from other churches. FRC operates in a similar manner. Local churches who share FRC’s Christian beliefs, core values and sense of mission may associate with FRC (and other churches) to jointly pursue their common beliefs and mission. If it is determined that a partner church no longer shares FRC’s beliefs and/or mission, or permits conduct inconsistent with FRC’s beliefs and mission, then that church may be removed from the association.”

Source: ProPublica

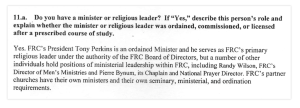

The IRS bought that argument, as well as the argument that Family Research Council has an established place of worship in its headquarters chapel and has a “minister or religious leader” in its president, Tony Perkins. (For more excerpts of the IRS application, see the ProPublica article.)

These questions come from a set of 14 criteria the IRS loosely uses to evaluate organizations that claim to be churches, although applicants do not have to meet all 14 criteria or any stated number of the criteria because “other facts and circumstances” may be taken into account, the IRS says.

Those 14 criteria include having a recognized creed and form of worship, having a distinct religious history, ordaining ministers who have completed a prescribed course of study, and having established places of worship and regular religious services.

The IRS and churches

Historically, the IRS has been reticent to get too deeply involved in matters of religious practice. However, there are some notable exceptions — the most famous of which is the Church of Scientology.

Historically, the IRS has been reticent to get too deeply involved in matters of religious practice.

Through 37 years of litigation, the government claimed Scientology isn’t a church at all but a business scheme intended to enrich its founder, L. Ron Hubbard, and others. In 1993, the IRS relented and granted tax-exemption to major segments of Scientology.

The run-up to that outcome, as documented by the Los Angeles Times and Wikipedia, included a “religious makeover” of the organization in 1990.

L. Ron Hubbard

Hugh Urban, writing in The Church of Scientology: A History of a New Religion, explained that Hubbard ordered Scientology organizations to display religious paraphernalia such as crosses and copies of the Scientology “Creed,” to hold “Sunday services” and establish chapels in their buildings. He said: “Visual evidences that Scientology is a religion are mandatory.” Wikipedia then summarizes Urban’s report: “Scientology auditors, previously known as counselors, were renamed ‘ministers’ and instructed to wear white collars, dark suits and silver crosses. Similarly, customers were renamed ‘parishioners’ and franchises were renamed ‘missions.’”

Then in 2019, the IRS granted church status to the Satanic Temple, which made headlines even in Rolling Stone.

Conservative Christians didn’t like this IRS decision one bit, as reported by the Los Angeles Times in a story with the headline: “The IRS Gave Nonprofit Status to a Satanic Church. Will All Hell Break Loose?”

This is different than the Johnson Amendment

Whether a nonprofit is classified as a church or not has no bearing on the Johnson Amendment, an IRS regulation in the news quite a bit lately.

This 1954 law says 501(c)(3) organizations — which includes churches and many other nonprofits — may not endorse political candidates or participate in partisan political campaigns, under threat of losing their nonprofit status. Being labeled a “church” does not take away scrutiny on this issue; in fact, it likely increases scrutiny.

Jennifer Hawks

Jennifer Hawks, associate general counsel at Baptist Joint Committee for Religious Liberty explained: “Once parachurch and other nonprofits reclassify for tax purposes as churches, they are still bound by the rules applicable to all 501(c)(3) organizations including neither endorsing nor opposing candidates for elected office. This change in tax status does not permit partisan campaigning. Where they once had some accountability through the IRS Form 990, donors and others associated with these groups will have to find new ways to hold these organizations accountable.”

So the very parachurch organizations that have sought shelter from financial and hiring scrutiny by being reclassified as churches could open themselves to more attention for their partisan political activities. Could — if the IRS actually enforced the Johnson Amendment.

In the 68 years since passage of the Johnson Amendment, the IRS has revoked the tax-exempt status of only one church — despite numerous calls for investigations when pastors have explicitly endorsed candidates from the pulpit.

Still, the threat of the Johnson Amendment has been enough to keep most pastors and churches in line — with notable exceptions.

The most flamboyant recent exception is Greg Locke, pastor of Global Vision Church in Nashville, Tenn. Locke has made all manner of outlandish declarations, including denying the reality of COVID-19, saying there are witches in his church and he knows who they are, to declaring that he will not allow any Democrats to be members of his church and that no Democrat can be a Christian.

Not that any Democrats would want to be a member of his church, that last statement was a clear violation of the Johnson Amendment and prompted loud calls for the IRS to revoke the tax-exempt status of Locke’s church.

The case was so egregious that the IRS would be compelled to investigate or lose all moral authority on the law.

Locke beat the IRS to the punch, however. In a May 22 sermon, he announced: “I dissolved our stinking 501(c)(3) in this church, because the government ain’t gonna tell me what I can and what I can’t say. So IRS, we don’t need your stupid tax exempt status. You can put it in a bag and burn it in your front yard for all we care. I renounce 501(c)(3) communism in this church! So we’ll say what we want to, Skippy Lou. The IRS, the FBI and everybody we’ve been turned in to can eat my dirty socks on live TV. I’m sick of it!”

Although much of the Christian world might disagree, Global Vision Church is still a church — even without formal recognition from the IRS.

Related articles:

Does the Johnson Amendment have any teeth left?

Still no external review of North American Mission Board finances